http://www.strategicmate.com/bleurock-hawk-down---eur.html

When U.S. Secretary of State Hillary Clinton and Treasury Secretary Timothy Geithner visit Beijing later this month, the value of the China's yuan will top the agenda. World currency markets may have already settled that debate.

Pushed by angry U.S. legislators anxious to brand China as a "currency manipulator," the U.S. Treasury secretary tried to strong-arm China into revaluing the yuan - all because of an assumption that the Asian giant wasn't allowing its currency to appreciate.

Unfortunately for Geithner, those efforts were stymied by a flood of data that actually demonstrates that China's currency has significantly appreciated against the already-wheezing greenback.

Never the quitter, Geithner next sought help from the Group of 20 as a means of turning a unilateral political issue into a multinational one (kind of like the Coalition in the Gulf War ... but with money instead of smart bombs).

Initially, India and the ministers were behind him. But when push came to shove, Geithner apparently lost his backing - judging from the fact that letting the yuan appreciate against the dollar wasn’t even mentioned in the G20's most-recent communiqué.

Now even the Greek debt crisis is working against the embattled Treasury leader and may actually short-circuit any possible hope that he could induce China to remove the yuan's currency peg against the dollar.

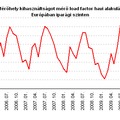

During the six-month stretch that ended with the close of April - right when Geithner was making his last-ditch pitch to the G20 - the yuan had soared by 12% against the euro. Meanwhile, there was a 3.01% gap in the "spot" versus "forward" rates in the yuan versus the dollar: The yuan ended April at about $6.62 to the dollar, meaning the greenback, in real time, is worth less.

Perhaps not surprisingly given recent events surrounding the Greek contagion, this suggests This means the euro is in real trouble and China has very little incentive to remove the peg to the dollar because of the dollar's relationship to that European currency.

Treasury Secretary Geithner makes the case - as does the International Monetary Fund (IMF) - that having China revalue the yuan would help put the big chill on "excess demand pressures." But until the world decides it no longer wants to buy what China has to offer, this revaluation makes no more sense than his argu e ment .

Deficits do not reflect bad currency policies. They reflect the fact that the world is all too happy to purchase billions of dollars in Chinese manufacturing capacity, services and products.

It's worth noting that nobody thought this was a bad idea when times were good and the benefits of having done so went right to the bottom line.

Címkék: amerika attila beijing dollár dollar euro eurusd fed geithner jüan kína kovacs mate peking usa yuan